Steps to Buying a Home in Arizona

Embarking on Your Home Purchase

1) Determine you are ready.

- If you are paying rent, you are probably financially able to buy.

- The landscape of financing has changed – no more 20% down and no less than stellar credit score exclusions.

- It does not have to be complicated – the right Realtor will find you the right house at the right time.

2) Finding a Realtor.

- The right Realtor will educate you on the current market conditions.

- They will listen to your needs and wants.

- They will advocate and negotiate on your behalf once you find the home that fits your needs.

3) Obtaining financing.

- Select a Loan Officer or Mortgage Specialist.

- Submit a loan application and receive a pre-qualification form or pre-approval letter.

- Start hunting for your new home.

4) Deciding how much you want to spend.

- The lender determines how much you can borrow, but only you know what you can afford based on your spending habits.

- Make sure to leave room for the “what ifs” in life – repairs, maintenance, and the unexpected.

- Be proud of this financial investment as you build equity, value appreciation, and reap the tax benefits.

5) Find the perfect home.

- Things to consider are location, size, commute, and amenities.

- Are you interested in a new build or a fixer upper?

- Is there a particular neighborhood you are looking at?

6) Making an offer?

- Your Realtor will prepare the contractual documents to submit an offer on your behalf.

- Submit your offer amount based on the value of the property, which can be determined by running a comparative market analysis of other homes in the area that are similar to the one you want to buy.

- Be prepared for negotiating back and forth.

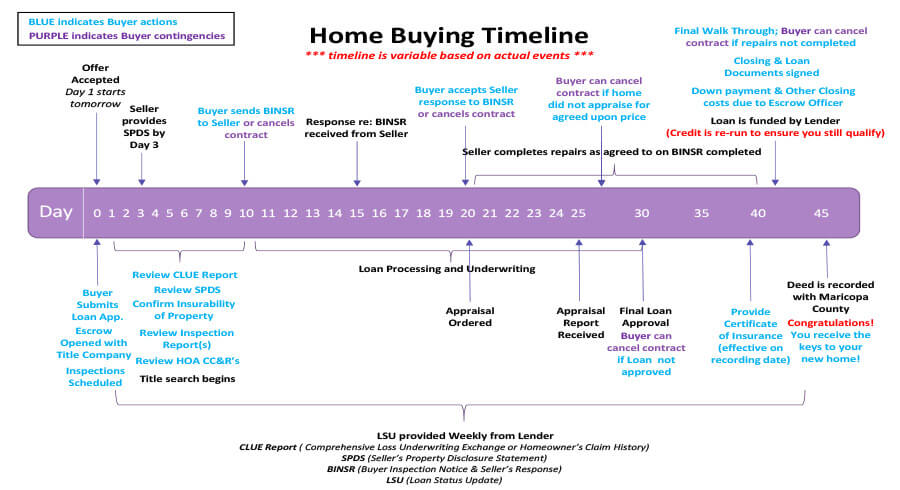

7) Entering into escrow.

- Once your offer is accepted, the purchase contract will be submitted to the Title Company and your earnest money will be deposited so escrow is opened.

- Your Realtor will walk you through each step of the process.

- This is the time period for performing inspections and ordering an appraisal.

8) Closing on your new home.

- Make sure to refrain from making large purchases before your closing date.

- Meet at the Title Company to sign all required paperwork.

- Get the keys to your new home!

Visualizing the Ideal Home

1) Common features to consider.

- Age of the property – new build versus resale home.

- Number of bedrooms.

- Number of bathrooms.

- Square footage.

- Single story or multi-level.

- Parking accommodations.

2) Amenities.

- Office.

- Pool.

- Security system.

- Workshop/studio.

- Fireplace.

- Patio, deck, or porch.

- Guest house.

3) Location.

- Commute time to work or school.

- School districts.

- Proximity to airport.

- Access to major highways and interstates.

- Distance to public transportation.

Questions for Your Potential Realtor

- Why did you become a Realtor?

- What is the benefit working with you?

- How do you make sure the process goes as smoothly as possible?

- Do you work with specific lenders or professionals in the industry?